Trade cryptocurrency

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. https://wrennawatson.com/can-i-get-my-money-back-if-i-lost-at-the-casino/ Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

You’ll also notice the difficulty level for this block. The Bitcoin network aims to produce one block every 10 minutes or so. The system is designed to evaluate and adjust the mining difficulty every 2,016 blocks or roughly every two weeks (based on the number of participants). This doesn’t always result in a block time of 10 minutes, but it’s close.

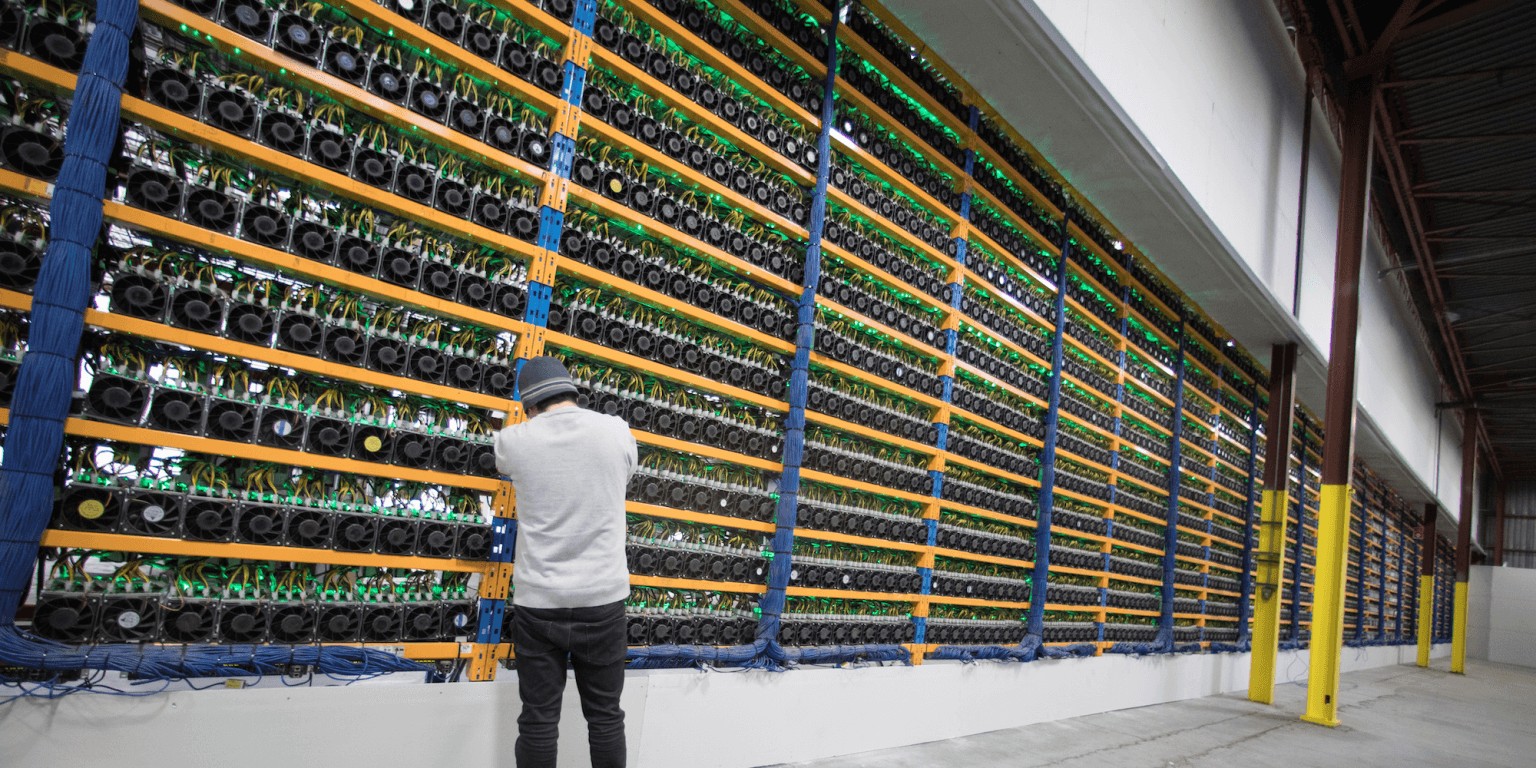

Bitcoin mining is the process of creating new bitcoins by solving extremely complicated math problems that verify transactions in the currency. When a bitcoin is successfully mined, the miner receives a predetermined amount of bitcoin.

Cryptocurrency regulation sec

The Securities and Exchange Commission’s (SEC) enforcement action against Coinbase, Inc. and Coinbase Global, Inc. has garnered significant attention due to its implications for the broader cryptocurrency industry. At its core, the case challenges whether Coinbase’s crypto-asset trading platform, staking program, and related services operate within the framework of federal securities laws. The ruling by the US District Court for the Southern District of New York provides critical insights into the legal definition of securities and sets the stage for ongoing debates over the regulation of crypto-assets (Sec. & Exch. Comm’n v Coinbase, Inc (2024) SDNY 23 CIV 4738, (2024) WL 1304037).

The cryptocurrency market experienced major growth in recent years and whether the U.S. Securities and Exchange Commission (SEC) should regulate cryptocurrency has become the center of attention.1 Senator Warren wrote to the SEC’s chairman Gary Gensler questioning if the SEC has authority to regulate cryptocurrency exchanges.2 With the volume of cryptocurrency trading growing tenfold on the popular exchange platform Coinbase in the last year, Warren warned about the potential danger for investors in the absence of any regulatory protections.3 The potential dangers include market manipulation, faking high volumes of trading, and cryptocurrency scams exploiting the platform’s anonymity.4 The SEC’s regulation could reduce volatility in the crypto market, but imposing compliance costs could also risk taking down the entire market, given the decentralized nature of cryptocurrency. How to protect the interests of potential investors without destroying the market became a major question for institutional regulators.

Political will is just one factor influencing the future of crypto asset securities regulation. The SEC’s mixed record in court, potential shifts in regulatory policies under different administrations—not to mention existential questions about the very authority of regulatory agencies—have only extended the uncertainty for the crypto industry in the U.S.

The Securities and Exchange Commission’s (SEC) enforcement action against Coinbase, Inc. and Coinbase Global, Inc. has garnered significant attention due to its implications for the broader cryptocurrency industry. At its core, the case challenges whether Coinbase’s crypto-asset trading platform, staking program, and related services operate within the framework of federal securities laws. The ruling by the US District Court for the Southern District of New York provides critical insights into the legal definition of securities and sets the stage for ongoing debates over the regulation of crypto-assets (Sec. & Exch. Comm’n v Coinbase, Inc (2024) SDNY 23 CIV 4738, (2024) WL 1304037).

The cryptocurrency market experienced major growth in recent years and whether the U.S. Securities and Exchange Commission (SEC) should regulate cryptocurrency has become the center of attention.1 Senator Warren wrote to the SEC’s chairman Gary Gensler questioning if the SEC has authority to regulate cryptocurrency exchanges.2 With the volume of cryptocurrency trading growing tenfold on the popular exchange platform Coinbase in the last year, Warren warned about the potential danger for investors in the absence of any regulatory protections.3 The potential dangers include market manipulation, faking high volumes of trading, and cryptocurrency scams exploiting the platform’s anonymity.4 The SEC’s regulation could reduce volatility in the crypto market, but imposing compliance costs could also risk taking down the entire market, given the decentralized nature of cryptocurrency. How to protect the interests of potential investors without destroying the market became a major question for institutional regulators.

Cryptocurrency market cap

The validity of each cryptocurrency’s coins is provided by a blockchain. A blockchain is a continuously growing list of records, called blocks, which are linked and secured using cryptography. Each block typically contains a hash pointer as a link to a previous block, a timestamp, and transaction data. By design, blockchains are inherently resistant to modification of the data. It is « an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way ». For use as a distributed ledger, a blockchain is typically managed by a peer-to-peer network collectively adhering to a protocol for validating new blocks. Once recorded, the data in any given block cannot be altered retroactively without the alteration of all subsequent blocks, which requires collusion of the network majority.

The How-To guides, located in the learn section, are made to assist users of any experience level with help on ‘how to’ perform certain actions, such as, on-chain transactions, navigate exchanges, or complete other crypto-related activities. Our comprehensive guides provide clear, step-by-step instructions accompanied with images. This resource empowers everyone—from beginners to experts—to get the most of crypto with ease and confidence.

On a blockchain, mining is the validation of transactions. For this effort, successful miners obtain new cryptocurrency as a reward. The reward decreases transaction fees by creating a complementary incentive to contribute to the processing power of the network. The rate of generating hashes, which validate any transaction, has been increased by the use of specialized hardware such as FPGAs and ASICs running complex hashing algorithms like SHA-256 and scrypt. This arms race for cheaper-yet-efficient machines has existed since bitcoin was introduced in 2009. Mining is measured by hash rate, typically in TH/s. A 2023 IMF working paper found that crypto mining could generate 450 million tons of CO2 emissions by 2027, accounting for 0.7 percent of global emissions, or 1.2 percent of the world total